Deferred Schedules

In Nimble AMS, deferred schedules are used to track and manage the automatic recognition of your deferred revenue. If your association is using deferred revenue in Nimble AMS, deferred schedules are created automatically for orders that include products with a deferred revenue method.

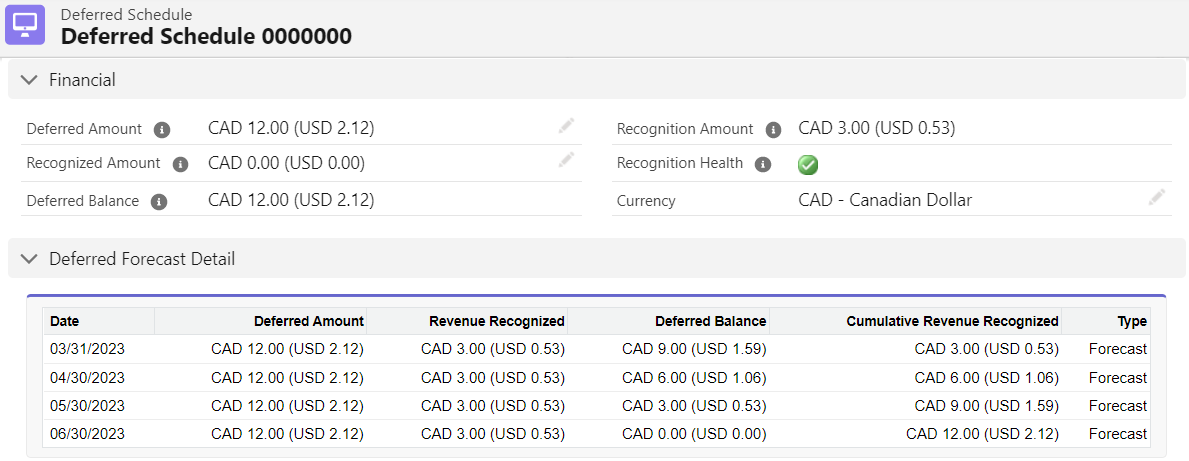

Information on a Deferred Schedule

Nimble AMS uses deferred schedules to automatically generate the transactions to recognize outstanding deferred balances. The key information needed for the automated process is recorded on the deferred schedule:

Field | Description |

|---|---|

| The method determines the rules for how the recognition occurs |

| The GL account where the deferred revenue is first recorded by the order process, and comes from the deferred revenue method |

Recognized Revenue GL Account | The GL account where the revenue is recognized |

Deferred Term | The number of months over which the revenue will be recognized |

Start Date | When does the revenue recognition begin |

Deferred Amount | The total amount that was deferred |

| This field is populated when deferred schedule data is imported or manually added from a third-party system. Nimble AMS uses this field to recognize an imported deferred schedule at the appropriate time. If your data was imported into Nimble AMS prior to the Winter '19 release, this field will remain blank or be unused unless new data is imported. |

The deferred schedule detail page also includes related lists of the order item lines and transactions that are linked to the deferred schedule.

Deferred Schedule in Internationalization

If you have enabled Salesforce multi-currency, Salesforce introduces the Currency field on all object layouts within your org.

While a new Deferred Schedule record gets created, the Currency field value on this record gets populated based on the Currency field value of the Entity/Product/Deferred Revenue Method that these records were linked with.

Also, once the record is saved, you will not be allowed to edit the value of the Currency field.

Deferred Schedules Creation

The Deferred Revenue Recognition is set by an administrator and can be set to Detail or Summarized.

The default for Deferred Revenue Recognition is Summarized and is recommended for most associations. If the Deferred Revenue Recognition setting is set to Summarized, a new deferred schedule is created only if an existing summary deferred schedule with the same recognition requirements does not already exist. The matching is based on comparing the Deferred Revenue Method, the Recognized Revenue GL Account, and Start Date.

If the Deferred Revenue Recognition setting is set to Detail, a new deferred schedule is created for each deferred product in an order. Selecting this option may use significantly more data storage and is not recommended for associations with a high volume of orders with deferred products.

Cancel Membership Mid-Term

Deferred revenue recognition gives us the advantage of recognizing only the revenue for the duration of product and service used. Nimble AMS has put this advantage to good use in the Cancel Membership Mid-Term feature which allows the staff user to cancel a membership part-way through a member’s term and issue a refund from the deferred revenue.

Deferred Schedules on Coupon Products

In case a coupon is applied on a product marked for deferment, the deferred schedule will be available in the coupon product in exactly the same way as product. For information, see (SPR25) How to Set up Deferred Revenue for Coupons and (SPR25) Deferred Coupons Management.